What are Housing Benefits and Council Tax Support

Housing Benefit

Housing Benefit is help towards paying your rent.

If you live in privately rented accommodation Local Housing Allowance (LHA) may be used to calculate your entitlement to Housing Benefit

If you rent from a Housing Association the amount of Housing Benefit you get may be affected by the under-occupancy charge.

From 25 July 2018 we went live with Universal Credit Full Service. From this date we cannot accept new claims for Housing Benefit for working age customers unless you:

- live in Exempt or Specified Supported Accommodation - this does not apply if you live in supported accommodation that is not classed as a Hostel and is managed by Sunderland Care and Support or Together for Children where the Council is your landlord - you must apply for Universal Credit to help with your housing costs

- have been placed in Temporary Accommodation - this is where you have been placed in accommodation by the Council to discharge our homelessness function and the landlord is the Council or a Housing Association

If the above does not apply to you, please make a claim for Universal Credit

If you are already claiming Housing Benefit and have a change of address within the city, a new claim is not required. You can continue to receive your housing costs via Housing Benefit by completing the moving home form.

Housing Benefit Estimates

To find out if you qualify for Housing Benefit based on your current circumstances use this online calculator

Council Tax Support

Council Tax Support is help towards paying the council tax you or your partner pay for your property, and it is deducted from your Council Tax Bill.

Sunderland's Council Tax Support scheme has been developed in line with the guidance from Central Government and can be viewed in full below.

The Council Tax Support scheme for working age people will change from 1 April 2025. Council Tax Support will be assessed using an income banded scheme based on your net household income.

The scheme has been changed to ensure that those with the lowest level of income receive the most help. It is less complex so it is easier to understand, it is simpler to administer therefore applications can be processed quicker, and there will be fewer changes to your entitlement as it will only change if you move into another income band.

Before 1 April 2025, the most a working age claimant could receive in Council Tax Support was 91.5% of the charge. We will now pay up to 100% of the council tax charge.

Scheme Summary

The level of your support will be based on a comparison of household size and income for you and your partner.

- Some types of income will be disregarded when working out your total weekly income, such as Child Benefit, Child maintenance payments, War Pension, War Disablement Benefits, Disability Living Allowance (DLA) and Personal Independence Payment (PIP).

- We will also disregard the Housing Element of Universal Credit.

- If you are working the first £25 of your weekly earnings will be disregarded.

- There will be no deduction from your entitlement if you have any non-dependents living with you.

Income Banded Scheme and how it works

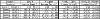

The following tables should help you work out how much Council Tax Support you can get.

You will need to look at your total income for you and your partner, and then remove any disregard as outlined above to determine your net income. Compare your net income to the table below to find out which band you fall into.

For example, if you are a single person with two children and your netweekly income is £400.00, you will get a discount of 60% on your Council Tax bill.

If you are receiving Income Support, Income Based Jobseeker's Allowance or Income Related Employment and Support Allowance, you will receive a Band 1 discount.

If you are currently in receipt of Local Council Tax Support, your income details will be transferred across to the new scheme. If your circumstances have changed recently, please report the details of the change to benefits@sunderland.gov.uk or by completing the online form here.

If you are suffering extreme financial hardship as a direct result of the implementation of the Local Council Tax Reduction Banded Scheme, you can make an application for a section 13A hardship payment.

You will therefore need to provide evidence to demonstrate your exceptional circumstances in line with the Exceptional Hardship Payment policy. To make a claim please complete the on-line Council Tax Reduction Exceptional Hardship Payment application form.

Pension age claimants are not affected by the change.

2025 Council Tax Support Regulations. (PDF, 1 MB)

You must make a claim for Council Tax Support even if your Housing costs will be covered by Universal Credit.

Lightning Reach Financial Support Portal

Sunderland City Council have partnered with Lightning Reach to connect you to 2,500+ support schemes from charities and organisations across the UK. Find out more at Lightning Reach